What Small Business Entrepreneurs must do to fetch Sustainable Long-Term Valuation

We have often seen small company entrepreneurs struggle to raise funds or partner with other companies or find it very difficult to become part of a larger group/company in their industry/sector. Valuation, or more so the proper valuation, is the critical challenge. Entrepreneurs/Owners fail to unearth the fundamental valuation of their business due to several factors. They are unable to describe and analyze their Company’s strategy in terms of how the Company intends to create long-term sustainable value.

Most of these are too small to gauge exact valuation, while a large number of them have below-par internal control, business processes, and financial reporting mechanisms. A few may possess valuable intangibles worth millions, but they lack the knowledge or resources to value their true potential. For the same reason, small entrepreneurs’ business is considered the most illiquid segment from the investment perspective.

Things can, however, be different if all ingredients to stitch the valuation are put in place. Concerns among potential investors lie in factors as illustrated below.

It’s essential to address the points mentioned above. A robust business model with clarity on revenue streams and their drivers can make investors gain interest in a small business. An important asset is a comprehensive market study of the opportunities, challenges, and risks and how the Company plans to action its strategies to counter risks. Investors look for a solid financial plan projecting business numbers, Capex, funds use, and profitability, including IRR, NPV, etc. A strategic valuation framework will give a lot of emphasis to how the Company generates a sustainable revenue stream.

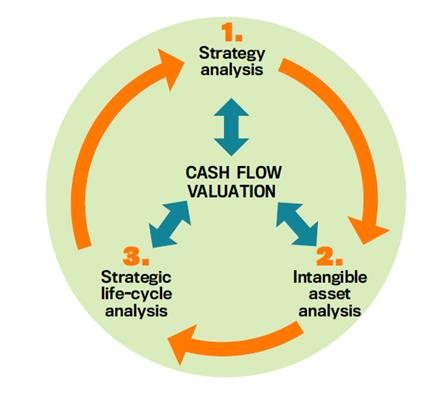

Strategic Valuation Process

The Strategic Valuation Process is designed by Mark L. Frigo, a co-founder of the Strategy, Execution and Valuation Initiative and Strategic Risk Management Lab in the Kellstadt Graduate School of Business at DePaul University. He is also an Advisor & Thought Leader at Kenilworth Global Fin Advisors

Some of the small businesses have people with no previous achievements. While this is something investors will see, one can offset this limitation by appointing a strong advisory board that comprises relevant industry knowledge and expertise. A good board or advisory panel can change the perspective with which investors look while making an investment decision

What Small Business Entrepreneurs Need To Do

Usually, small businesses work with one or two promoters, which risks the continuity of the Company. To counter this, some enterprises build a comprehensive and distributed set of business operations that don’t affect business on the exit of one of the key contributing promoters. The Company continues on the back of a strong team and management that creates a robust set of internal governance, management, and even succession.

Another important aspect – early dilution by a promoter can be counterproductive for a small business. Too many owners at an initial stage might dilute the interest of a VC/PE firm or other financial investors. An important factor that also affects small businesses is the illiquidity of their investment. It’s challenging to sell and exit a part of the stake in this business. Also, it is relatively difficult to raise capital/debt. Proper structuring and the mix of different instruments while designing a company’s capital structure must be done through a well-thought process. Many of us have seen the use of preferred equity, optional convertible debt/loan, differential voting rights, veto powers, etc., to make investors more comfortable exercising their right to conduct a company’s business.

A long road map and fogging business plan when there is little clarity of business and its growth are something that the investors run away from. The business plan should be very clear about the milestones, key performance indicators, timelines, and targets – financial/nonfinancial. It must highlight the clear vision of the founders, key management, and the board of directors that shows proper sync in terms of a robust strategy to achieve set goals.

Disclaimer

This article is published by Kenilworth Global Fin Advisors solely for information and guidance purposes and is not intended to render any advice. Kenilworth Global Fin Advisors holds the copyright in the article. Any reproduction of the published material for commercial or non-commercial purposes is prohibited unless written approval is from the Company.