While the economic growth across major economies is already being challenged, inflation remains an added force that concerns central banks across these economies.

The rise in the central bank rates is one option to help tackle inflation, provided handled with a delicate balance. In an ideal condition, rising rates lead to expenditure reduction to stabilize prices. On the other hand, economic growth slows down as borrowing costs for companies increase, and access to capital becomes costlier.

What does it mean for the US:

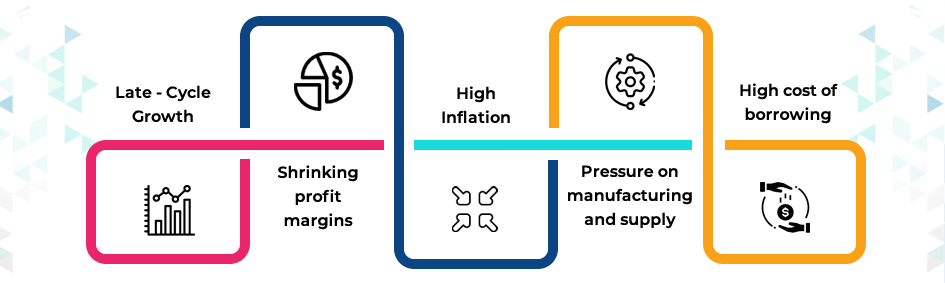

- The United States is in a late-cycle growth phase with a higher-than-before danger of recession.

- A tough labor market, shrinking profit margins, growing inventories, a tightened monetary policy, and a flattened yield curve are some of the US economy’s late-cycle tendencies.

- Although nominal wage growth is at its highest level in years, high inflation has negatively affected real wage growth, consumer confidence, and real income expectations.

- Pressures related to the manufacturing supply have begun, and inflation in the housing and food markets is still on the higher side, suggesting that inflation will likely be a significant concern and stay higher than levels seen in the past.

- The cost of borrowing has increased due to Federal Reserve (Fed) rate hikes, specifically for mortgage rates.

Given the Ukraine war and increasing gas prices, economies in Europe are exposed to a higher risk of recession. While China continues to face challenges, lockdowns have only added fuel to the fire of industrial growth. Globally, late-cycle patterns are visible across all manufacturing and services sectors. Read our previous blog 4 trends to watchout for in H2 2022 for more information.

Market comparisons can be used to value investment by looking at similar investments that have been made in the past. The risk premium is a percentage that is added to the expected return on investment to account for the riskiness of the investment.

Things are not bad yet, but they are close to getting worse if things turn hostile. Business investment could grow at a prolonged slow rate, companies will be cautious, and valuation multiples could go down faster than in recent times. We have already seen a series of layoffs and employee displacements.

Large global conglomerates have cut down their capex and budget allocations and are far more cautious than ever. Which makes things very vulnerable in the months to come. Post Pandemic growth could trickle off in a couple of quarters if events turn the other side.

Kenilworth Global Fin Advisors, an industry leader in providing business research services in Chicago, top Investment Research solutions in USA & corporate Valuation Services in USA. We provide organizations with collaborative, secure and customized solutions. The informational, safe, and integrated solutions help businesses save time and money on corporate transactions and make smarter investment decisions. For further information, book a free consultation with John@kgfinadvisors.com to determine how it will benefit you.