The dark night rises and brings back with it the term stagflation. The world has seen it earlier, but COVID has resurrected it from the dead. A lethal combination of stagnant/negative growth and high inflation and the heady cocktail is coined “Stagflation”.

The paradox here is that the usual measures for controlling itself are counterproductive and may lead to further economic depression. Raising interest rates to counter inflation will only make borrowing more expensive. The outcome will further dampen economic growth.

History has witnessed stagflation earlier. In the US, when inflation went up to 13%, unemployment was more than 10%.

In the recent scenario, countries have witnessed many starts and stops. Lockdowns the world over have slowed down economies. Supply and demand have suffered a hit in the aftermath of COVID, which still needs registering. Consumers are not confident buyers anymore.

For businesses to regain their strong standing, social and economic reemergence is necessary. Companies need to leverage efforts from identified phases to transform and achieve success in this post-COVID world.

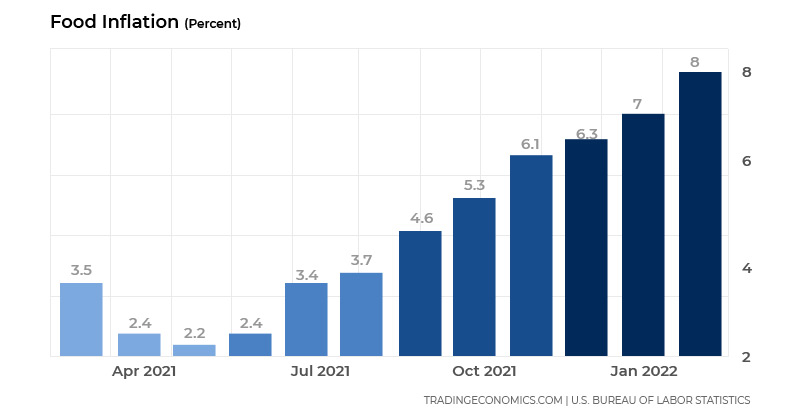

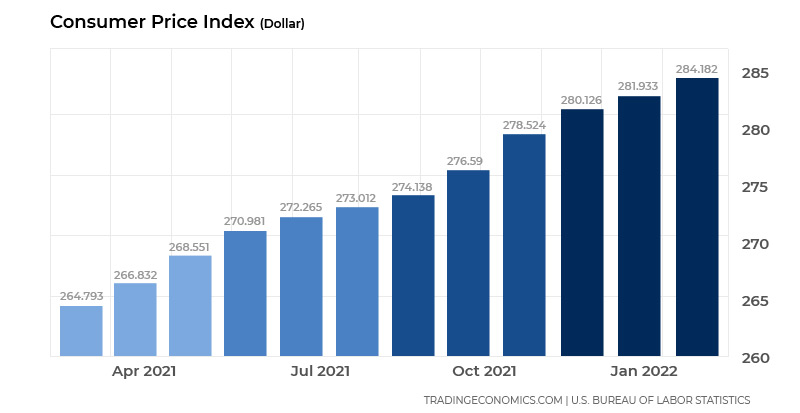

There is already pressure on the global supply chain at a time when demand is high, and this is further making the upwards spiral of higher average prices even worse. The economic and financial fallout from the Russia-Ukraine war and the resulting stagflationary shock will have repercussions across the globe.

As the Western EU countries are dependent on Russia for gas, they will face harsh consequences. An otherwise strong US economy is likely to face a sharp slowdown, moving toward stagflation led recession. Tougher financial conditions and the challenging outcomes on business, consumer and investor confidence will only heighten the negative macro consequences of Russia’s invasion all over the world.

The future will only repeat what had happened earlier in the US. Chances are it will only worsen. Wheels have been set in motion, and there seem to be no signs of recovery. All the indicators are in the direction of highlighting that the UK economy could be heading for a repeat of 1970s stagflation. EU countries, too, will face the outcome. Governments all over the world are faced with the tough job of controlling spiralling inflation.

Putin has struck not only Ukraine but also given a blow to global confidence at a time when the already struggling economic recovery was entering a period of uncertainty and increasing inflationary pressures. The after-effects from the Ukraine war will be anything but brief.