Despite a Huge Rally Since the Spring of 2020, the Stock Market’s Fundamental Valuation is About Where It Was Pre-Pandemic; A Flattish, Choppy Market in 2022 Seems Most Likely; A Significant Rally or Decline Seems Less Probable

The S&P 500 Index has soared more than 40% since before the COVID-19 pandemic (indeed more than 100% from the pandemic lows). Many stock groups have participated in the rally, particularly the largest capitalization tech stocks, although some of the froth has recently come out of many even more highly valued, but less established names.

The obvious question as we approach 2022 is what comes next.

Despite the rally over last 21 months, the market’s current P/E valuation as measured by the S&P 500 is remarkably similar to what it was pre-pandemic. In February 2020, consensus full-year 2020 estimated earnings for the broad index was around $165. Coupled with a February 2020 S&P 500 Index reading of about 3,300, the market was trading at approximately 20x forward earnings. See Table 1.

Table 1: Selected Key U.S. Economic and Stock Market Parameters

| Today | February 2020 |

October 2007 |

March 2000 |

Comments | |

|---|---|---|---|---|---|

| Federal Funds Rate | 0.0% to 0.25% | 1.5% to 1.75% | Fed projections released on 12-15-2021 suggest that as many as three rate hikes may be implemented in 2022 and two more in 2023. | ||

| Quantitative Easing (Monthly Bond Buying) | $90 billion per month in 12/1/2021 | None | The Fed has been buying $120 billion per month for some time. That was decreased to $105 billion in November, $90 billion in December, $60 billion in January, and perhaps zero by March 2022. | ||

| Annualized Percentage Change in CPI, Ex- Food and Energy | 4.9% | 2.4% | |||

| Projected S&P 500 Earnings for 2020 (Consensus Estimate) | $165 | ||||

| S&P 500 Index in February 2020 | 3,300 | ||||

| Forward Multiple | 20 | ||||

| Projected S&P 500 Earnings for 2022 (Consensus Estimate) | $223 | ||||

| Current S&P 500 Index | 4,669 | ||||

| Forward Multiple | 21 | ||||

| Trailing 12-Months P/E Multiple |

17 | 28 | |||

| U.S. Government 10-Year Bond Yield |

1.43% | 1.58% | 5.0% | 6.26% | |

| Gold Price Per Ounce | $1,799 | $1,800 | |||

| Bitcoin | $48,123 | $8,500 | |||

| M2 Money Supply ($ trillions) |

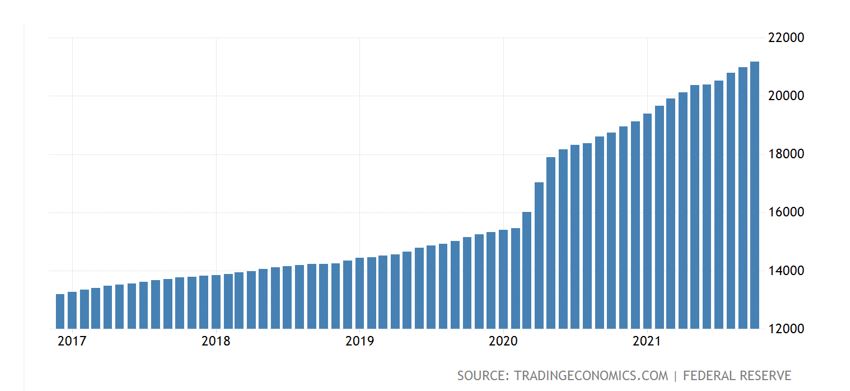

$21 | $15 | The M2 measure of money supply equals the total amount of coins and notes in circulation, as well as short-term time deposits in banks and certain money market funds. | ||

| U.S. Stock Market Capitalization-to-GDP Ratio | 204% | 155% | |||

| S&P 500 Dividend Yield | 1.30% | 1.80% | 1.7% | 1.1% | |

| Ratio of S&P 500 Yield to U.S. Ten-Year Bond Yield | 0.91 | 1.14 | 0.34 | 0.18 |

Today, investment strategists generally expect the S&P 500 to post about $223 of earnings in 2022, and since the index is around 4,669, the market’s forward looking multiple is broadly similar, around 21x. Long term interest rates are also little changed from their levels in early 2020 — a current U.S. ten-year Treasury Bond yield of 1.43% versus around 1.58% in February 2020.

The first basic question for investors is: does the market face the risk of a significant downturn? Based on key statistics from the most recent peaks which preceded marked downturns in October 2007 and March 2000, the answer appears to be no. The starkest difference between current conditions and those peak times is that the present 1.30% dividend yield nearly equals the longer-term risk-free rate (ten-year Treasury yield) of about 1.43%. At the times of the previous two stock market peaks, the gaps between income available from stocks and bonds decisively favored bonds. The S&P 500’s dividend yields in October 2007 and March 2000 represented only 34% and 18%, respectively, of the ten-year yield at those times.

What is different between early 2020 and the current environment is prospective Fed policy, which of course is heavily influenced by the level of inflation in the economy. In early 2020, the Fed had adopted a roughly neutral monetary policy with the Fed funds rate set at 1.50%-1.75% and no quantitative easing (monthly bond buying) program in place. CPI inflation (ex-food and energy) was running at a 2.4% pace.

The picture is far different today. The Fed funds rate is currently 0%-0.25%, having been cut to that level in March 2020 when the effects of the pandemic started to become known. The Fed also engaged in an aggressive bond buying program — initially $120 billion per month which has been “tapered” to a $90 billion pace in December 2021. The net effect of all this has been a giant increase in money supply and inflation. The M2 money supply measure is now around an unprecedented $21 trillion, up sharply from $15 trillion just 21 months ago. See Figure 1. The November CPI normalized gauge zoomed to a 4.9% annual rate.

However, in its December 15 policy statement, the central bank signaled it plans to begin to reduce its extraordinarily easy monetary policies. Three rate hikes are now expected in 2022, two more in 2023, and two more still in 2024. At the same time, monthly bond repurchases could end around March 2022. (It is of course debatable whether 50-75 basis points of tightening in 2022 will sufficiently quell the current inflationary flames.)

One of the oldest axioms in investing is “Don’t Fight the Fed.” In simple terms, investing in risky assets when the central bank is easing monetary conditions has been considered wise over the course of history and, unfortunately, vice versa. We might extend this thought a bit further; constructive Fed policy (the Fed “put”) has likely been the single most powerful force pushing the stock market higher. The market stands to lose a fair amount of that tailwind in 2022.

With the Fed embarking on a tightening program — admittedly from a very accommodative level — it seems reasonable that the stock market may have difficulty making substantial headway in 2022. A significant decline seems unlikely for the reasons described above, but a flattish, choppy stock market in 2022 seems to be the most likely course.

The current S&P 500 Index and the U.S. Treasury ten-year bond yield are 4,669 and 1.43%, respectively.